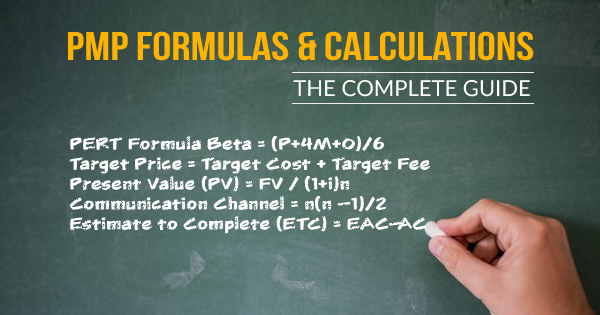

Are you preparing for PMP certification exam? If yes, there are some significant subject areas you should focus upon. PMP formulas are very important to pass PMP certification exam. Although there is no specific blueprint on the number of questions based on PMP formulas you can’t ignore these formulas during your preparation.

You may find a number of simple and direct questions based on the PMP formulas in the exam asked to check the understanding of these formulas. So, it becomes essential to have a good knowledge of these PMP formulas.

Must Read: Top 30 Project Management Interview Questions and Answers

PMP Formulas

Let’s move forward to learn the most common PMP formulas. We’ll discuss these formulas in detail but first, have a look at the quick PMP formula sheet. The below given PMP formula sheet represents the list of 25 PMP formulas to prepare for the PMP certification exam. We’ve put together a list of PMP formulas that you should know along with an explanation of how to use them. So, go through this PMP formula cheat sheet and take a step ahead for the preparation of certification exam.

1. Communication Channel

The communication channel can be defined as the number of ways by which information flows within the organization. A project manager acts as a link between the stakeholders and the customers. The direction of information flow in the communication channel can be upward, downward or sideways depending upon the position of project manager.

How to calculate communication channels?

The total number of communication channels can be calculated by using formula

Communication Channel = n (n – 1) / 2

Where ‘n’ stands for the number of stakeholders

(Remember that a stakeholder may be an individual, a group or an organization that is affected by the decision, activity or result of the project)

If there are 4 stakeholders then number of communication channel = 4 (4-1) / 2 = 6

If you know why projects fail, you are better prepared to defend against it. Here are top 10 reasons for the project failure!

2. Earned Value

It is a method of monitoring project plan, actual work, and completed work to check whether the project is going well or not. EV helps you to know if you are winning, drawing or losing and if so, by how much.

How to calculate earned value?

Earned value can be calculated as

Earned Value = % complete × Budget at Completion (BAC)

For example, if the project team has completed 150 man-hours of work and project required 600 man-hours of work to complete the project, then

% Complete = 150/600 × 100 = 25%

Budget at Completion = Total budget assigned for the project (let it be $40,000 in this case)

Then, EV = 25 × $40,000 = $10,000

3. Cost Variance

Cost Variance is one of the important PM formulas that is used for calculating project’s financial performance. It compares the budget decided at the beginning of the project and actually spent.

How to calculate Cost Variance?

Mathematically, it is the difference between earned value and actual cost.

Cost Variance (CV) = Earned Value (EV) – Actual Cost (AC)

For example, If Earned Value (EV) and Actual Cost (AC) for a project are $20,000 and $20,000 respectively then

Cost Variance = $20,000 – $20,000 = $0, which is perfect as project is exactly on budget.

The positive of Cost Variance shows the condition of under budget whereas the negative value of Cost Variance denotes the over budget.

4. Schedule Variance

A Schedule Variance is defined as the difference between the earned value and the planned value. It is one of the ways to check the project performance.

How to calculate Schedule Variance?

The formula for Schedule Variance is:

Schedule Variance = Earned Value (EV) – Planned value (PV)

(A negative value of SV refers that you are behind the Schedule and a positive value of SV refers that you are ahead of the Schedule)

For example, if EV for an app development project is $20,000 and PV is $30,000 then

Schedule Variance = $20,000 – $30,000 = – $10,000 (which shows that project is running behind the schedule by $10,000 schedule variance)

5. Cost Performance Index

The Cost Performance Index measures the cost efficiency of an ongoing project. It is another way of checking cost performance. Being a ratio, CPI is self- explanatory.

How to calculate Cost Performance Index (CPI)?

It is the ratio of earned value to the actual cost.

Cost Performance Index (CPI) = EV / AC

CPI can have three values (=1, >1or <1)

If CPI = 1, then it means that you are getting $1 for every $1 spent.

If CPI > 1, then it means that you are getting more than $1 for every $1 spent.

If CPI < 1, then it means that you are getting less than $1 for every $1 spent.

Looking for career development in Project Management? Let’s have a look how important is the certification to grow in Project Management.

6. Schedule Performance Index

It is a ratio of the earned value to the planned value. It is used to check whether the project is running at the expected rate or behind the schedule or ahead of schedule.

How to calculate Schedule Performance Index (SPI)?

Schedule Performance Index = Earned Value (EV) / Planned Value (PV)

As it is also a ratio then it can have three values (=1, >1 or <1)

If SPI = 1, it indicates that project is going at the same rate as expected.

If SPI > 1, it indicates that project is going at a faster rate.

If SPI < 1, it indicates that project is going at a slower rate.

7. Estimate at Completion (EAC)

It is a forecasting technique to predict the future project performance. EAC gives the forecasted value of the project at completion and it is the total amount that project will cost.

How to calculate Estimate at Completion (EAC)?

There are four formulas to calculate EAC.

1st Formula for the EAC

Estimate at Completion (EAC) = BAC / CPI

If CPI = 1 then EAC = BAC which means that you are able to complete the project with the provided budget without any forecasting analysis. Even at the starting of the project, Estimate at Completion is same as that of the Budget at Completion.

2nd Formula for the EAC

When you find out that cost estimate was flawed and you need to calculate the new cost estimate for the remaining project work. Then you need to move to the activity level in order to find the cost of every activity, and then add individual costs to get the total cost value of the remaining work/task. In this case, we use the following formula to find EAC

Estimate at Completion (EAC) = AC + Bottom-up ETC

3rd Formula for the EAC

If there has been occurred a deviation from the estimated budget but now you can perform the remaining task as per plan. This may happen because of an unexpected condition or increased cost. Thus, to find the value of EAC in this formula, money spent to date (i.e. AC) is added to the budgeted cost for remaining project work.

Estimate at Completion = Money spent to date + Budgeted cost for the remaining work

Estimate at Completion (EAC) = AC + (BAC – EV)

4th Formula for the EAC

When you are behind schedule, over the budget or the client requests you to finish/complete the project within preset time, both the schedule and cost are required to be taken into account, then this formula is applied to find the value of EAC. It is given as

Estimate at Completion = Money spent to the date + (Budgeted cost for the remaining work – Earned Value) / (Cost Performance Index × Schedule Performance Index)

Estimate at Completion (EAC) = AC + [(BAC – EV) / (CPI × SPI)]

8. Variance at Completion (VAC)

VAC is an alternate Earned Value Management (EVM) formula. Mathematically, it can be defined as the difference of Budget at Completion (BAC) and Estimate at Completion (EAC).

How to calculate Variance at Completion (VAC)?

Variance at Completion (VAC) = BAC – EAC

Remember that a $0 value for VAC indicates that you will hit the budget. A value less than $0 indicate that you will be over budget and a value more than $0 indicates that you will be under budget.

9. Estimate to Complete (ETC)

ETC is the second forecasting technique in project management that shows which amount is to be spent on the remaining part of the project to complete. Mathematically, ETC is the difference between earned at completion and actual cost. It can be calculated as

How to calculate Estimate to Complete (ETC)?

Estimate to Complete (ETC) = EAC – AC

10. To Complete Performance Index

It is defined as the calculated cost performance projection that can be achieved on the remaining work to acquire the goal such as BAC or EAC. IT gives us the additional information on project performance.

How to calculate TCPI?

Here are two formulas to calculate TCPI depending upon BAC or EAC is given.

TCPI = (BAC – EV) / (EAC – AC)

TCPI = (BAC – EV) / (BAC – AC)

Improper project management may result in project failure. Here are the project management techniques that will help you avoid project failure!

11. Standard Deviation (SD)

SD measures how much is the variation from the mean. It is used to analyze data. It is represented by sigma (σ).

How to calculate Standard Deviation?

Mathematically, sigma is the difference of distribution values on any end and in middle.

σ = (Pessimistic – Optimistic) / 6

A low value of SD shows that the data points are close to mean or average and a high value of SD shows that data points are spread over a large range.

Preparing for PMP certification exam? Take Whizlabs Free Practice Test now to check your current level of preparation with these 50 Practice Questions.

12. PERT Formula

PERT formula is a variation on three-point estimation and these three estimations are pessimistic (P), most likely (M) and optimistic (O).

How to calculate PERT?

PERT formula is based on Beta distribution.

Beta = (P + M + O) / 3

But PERT analysis uses the weighted average which is the four times of the weight of the most likely (M) estimation.

Beta = (P + 4M + O) / 6

As PERT uses three different estimations to reach final estimation, it reduces the possibilities of risks and also improves the estimation accuracy.

13. Expected Monetary Value (EMV)

The expected monetary value represents the expected money to be made from a specific decision.

To calculate the expected value, it considers the possibility of occurring of outcomes and the dollars assigned to each outcome.

The formula for calculating EMV

EMV= Probability * Impact

For example, if you roll a dice and bet $60 to receive a three. The possibility to get a three is 1/6 as there are possibilities to get from 1 to 6. The possibility to get some other is 5/6.

For the first case, the Impact for the event = $60

So, the EMV will be = $60 * 1/6 = $10

For the second case, the Impact for the event = -$60

So, the EMV will be = $60 * 5/6 = (-$50)

In the case of multiple events, the EMV of the events/risks is first calculated separately and then added. Now, the EMV for this scenario is calculated as below:

EMV = $10 – $50 = -$40

The calculation of EMV (Expected Monetary Value) helps to calculate the required amount for the management of identified risks and to select the choice that involves less budget for the risk management.

EMV is one of the PMP formulas from the Risk and Probability; you may find at least one question from risk and probability PMP formulas in your exam.

14. Risk Priority Number (RPN)

The Risk Priority Number (RPN) is all about assessing the risks in the Failure Mode and Effect Analysis (FMEA) and therefore helps in sorting the risks. To calculate RPN, detection, occurrence, and severity is taken into consideration, so let’s understand these terms first.

Detection:It is related to the capability of detecting the failure and is ranked from 1 to 10. Low rank of detection represents the high capability of detection.

Occurrence:It is related to the potential of failure occurrence and is ranked from 1 to 10. Low occurrence rank represents the low failure occurrence potential. The term occurrence is also known as the time frame.

Severity:It is related to the severity of the failure mode and is ranked from 1 to 10. Highly severed risks are given the higher severity. The term severity is also known as impact.

RPN is calculated by the multiplication of three scoring columns, Detection, Occurrence, and Severity. So, The formula for RPN is –

RPN = Detection * Occurrence * Severity

For example, if the detection score is 3, the occurrence score is 6, and severity score is 4, then the RPN will be –

RPN = 3 * 6 * 4

RPN = 72

RPN is the another from Risk and Probability PMP formulas, so don’t miss and prepare with it with a few examples.

15. Cost Plus Percentage of Cost (CPPC)

This is a particular type of contract where there is zero risk for the seller and it is the buyer that accepts it completely. From the buyer’s point of view, it is least likely cost-reimbursement contract because buyers need to pay the whole cost experienced by the seller plus additional fee.

In this contract, there is nothing to lose for the seller. As additional profit amount is a percentage of reimbursement cost, some unethical or insincere seller might not focus towards controlling cost because with an increase in cost, their profit increases.

Contract = Cost plus percent of the cost as fee

Preparing for Project Management Professional (PMP)® Certification Exam? Start your preparation with PMP® Practice Tests Now!

16. Cost Plus Fixed Fee (CPFF)

In this type of contract also, it is the buyer that accepts all the risk but unlike CPPC, here profit of seller doesn’t increase with the cost of the project. Here, the profit does not depend on the working efficiency and performance of the seller.

The profit is decided in the starting; generally, a significant percentage of estimated cost and remains same unless the scope or requirements changes.

Contract = Cost plus fee of fixed amount

17. Cost Plus Award Fee (CPAF)

In this contract, the risk is also shared with the seller. There is no fixed amount of additional fee. The buyer reimburses the actual cost to the seller with some additional amount based on the satisfaction of the buyer as per performance standards mentioned in the contract.

Contract = Cost plus an award fee (some amount)

18. Cost Plus Incentive Fee (CPIF)

It is a special type of cost-reimbursement contract where buyers pay the cost of the project plus some incentive to the seller. This incentive is to make the seller to enhance his performance and keep the cost of the project least possible.

Contract= Cost Plus Incentive Fee

19. Return on Investment

As the name suggests, it is the measurement of profit or loss gained through an investment based on the amount invested. ROI is calculated in terms of percentage and helps in making the financial decisions. It is used to measure the profitability of a business or company or to compare the efficiency and profitability of different investments.

The formula for calculating ROI is –

ROI = (Net Profit / Cost of Investment) * 100

For example, suppose an investor purchases a stock of worth $5000 and one year later, he sells it in $6000. The net profit for this investment is $1000 and ROI can be calculated as

ROI= (1000/5000) * 100 = 20%

Project Management glossary contains a number of terms to standardize project startup process. Here are the 10 project management terms you should know!

20. Payback Period

Payback period is the time period required to recover or earn back the invested money in any business. Generally, a business with a smaller payback period is considered better. To calculate the Payback Period, the cost of the investment is divided by the new cash flow.

So, the formula for calculating the PayBack Period is

Payback Period = Initial Investment / Periodic Cash Flow

For example, the investment of a company in a new manufacturing line is $400,000 and the manufacturing line produces a positive cash flow of $100,000 per year. Then the payback period in 4 years will be calculated as –

Payback Period = $400,000 / $100,000

= 4

It means the payback period will be the 4 years.

21. Cost-Benefit Ratio (CBR)

It is the ratio that tells about the profit to be received from an investment. It is the ratio of the net present value of the investment to the initial or actual investment cost. As this ratio tells about the profitability of a project, it is also known as profitability index. Ratio value greater than 1 indicates the viability and profitability of the project.

The formula for calculating Cost-benefit Ratio

CBR = Net Present Value of Investment / initial investment cost

Where the net present value is calculated by the following formula –

NPV = Value / (1 + r)^t

Where Value is the value of benefits, r is the rate of discount, and t if the defined time frame.

For example, a business is about to invest the amount of 100,000 in the production of a new product that will yield the revenue of $500,000 as per the calculations based on the present monetary value. Given that the inflation rate is 3% and the time frame is 2 years.

First, calculate the NPV such as

NPV = $500,000 / (1 – 0.03) ^2

NPV = $531,406

Now, the cost-benefit ratio will be calculated as –

Net Present Value / Initial Investment Cost

= $531,406 / $500,000

= 1.06

The result is a positive ration which means the project is deemed as the profit.

The negative cost-benefit ratio means the project is deemed as losing money.

22. Present Value (PV)

It is the value that defines the present worth of a future lump sum.

Formula for calculating present value is

PV = FV / (1 + i)^n

Where PV= Present Value, FV= Future Value, I= interest Rate and n= Time period

For example, an investment that earns 5% per year and can be redeemed for $10,000 in 10 years would have a present value of $ 6139. It can be calculated as –

PV = $10,000 / (1.05)^10

PV = $10,000 / 1.6289

PV = $ 6139

23. Future Value (FV)

It is the value of cash or asset at a particular date in the future based on the assumed growth rate.

FV = PV(1+i)^n

For example, if someone put $200 in the bank for 5 years at an interest rate of 5 %, then he will receive the amount calculated below.

FV = 200 (1 + .05)^5

FV = 200 * 1.2762

FV = $255.24

Present Value and Future Value are two important PMP formulas that belong to the category of project selection methods. The formula is simple, just remember and calculate with proper attention.

24. Target Price

Target price is a sum of target cost and target fee. It is used as a benchmark by both the buyer as well as the seller. If the final project cost is less than the target price, profit is shared between seller and buyer based on profit sharing agreement. For the price above the target price, the cost is shared between seller and buyer based on cost sharing document.

Target Price = Target Cost + Target fee

For example, the target cost is given as $200,000 and the profit for seller (Target Fee) is $10,000 then

Target Price = $200,000 + $15,000

Target Price = $215,000

25. Point of Total Assumption (PTA)

This concept is associated with fixed price incentive fee contracts. It is the amount above which all the losses of extra cost overrun are accepted by the seller.

PTA = [(Ceiling Price – Target Price) / Buyer’s Share Ratio] + Target Cost

For example, if the target cost is given as $1,000,000, the maximum price the buyer will pay i.e. ceiling price is $1,300,000, and the target profit for the seller is $100,000, then

Target Price = Target Cost + Profit of seller

= $1,000,000 + $100,000

= $1,100,000

Now, the Share Ratio is given as 80% – 20% for over-runs for buyer and seller, and 50% – 50% for under-runs

So, here we consider the Buyer’s Share Ratio 80% i.e. 0.80

Now, PTA = ((1,300,000 – 1,100,000) / 0.80) + 1,000,000

PTA = $1,25,000

PTA belongs to the series of Procurement related PMP formulas, so just understand the meaning and use of basic terms, remember the formula, and get ready to solve the question.

Final Words

To conclude, this article is very helpful to have an overview of PMP formulas that can be expected in the exam. Each PMP formula has been explained in a proper manner to understand the name of the formula, the formula itself, terms used in the formula, and an example with detailed description to find the solution. You may sometimes get confused about which formula to use and when. So, it becomes important to read the question carefully at that time to understand the question and apply correct formula to solve the question.

You can also try PMP online course and PMP practice tests to prepare for the PMP certification exam.

- Top 20 Questions To Prepare For Certified Kubernetes Administrator Exam - August 16, 2024

- 10 AWS Services to Master for the AWS Developer Associate Exam - August 14, 2024

- Exam Tips for AWS Machine Learning Specialty Certification - August 7, 2024

- Best 15+ AWS Developer Associate hands-on labs in 2024 - July 24, 2024

- Containers vs Virtual Machines: Differences You Should Know - June 24, 2024

- Databricks Launched World’s Most Capable Large Language Model (LLM) - April 26, 2024

- What are the storage options available in Microsoft Azure? - March 14, 2024

- User’s Guide to Getting Started with Google Kubernetes Engine - March 1, 2024

I would also include PERT Variance formula. Excellent list though! This was greatly helpful when studying. Cheers!

Sure, will consider to update and add the left ones. Thank you for the suggestion and appreciation 🙂

Best blog ever. I have been searching on the internet for blogs on project management professional, this blog contains valuable information where it is making everyone to understand the concept crystal clearly. I appreciate your hard work and effort. Good going blogger.

Thank you Stuart for the valuable and inspiring words 🙂

Thank you Neeru, All formulae in one place with detailed description. It helped me to study in 10 minutes. God Bless You.

Delighted, you found it helpful. Thank you for the kind words, Babu Paul 🙂

I have not operated as a project manager but part of a team so this has helped greatly in my PMP study. I was really frustrated and bewildered at the number of formulas to memorise but at least this breaks the list down. Must be a way to remember these like a rhyme or something. A question can you take a calculator in the exam?

Hi Richar

Yes, you are allowed to use calculator. You can not take your own calculator to the test room but you can use calculator on the computer screen or you can ask the staff for a calculator.

Thank you. You descriptions were very helpful, and you broke down the reasoning behind the calculations. Some areas where I *think* there are mistakes.

#21 Cost-benefit ratio. I think the example is wrong. When you have $531,406/$500,000 . shouldn’t it be $531,406/$100,000, because $100,000 is the initial investment and it should be NVP/initial investment? If not, could you please explain? I spent a lot of time on this one, trying to figure out what I was doing wrong, until I looked at another example elsewhere.

I also wasn’t certain how to calculate Planned Value in equation 6. Schedule Performance Index, I had some trouble with this one as well. Since Earned value is % complete/BAC, schedule Performance index is earned value/planned value, and planned value is (I think) % that I had originally planned on being completed at this point. The formula basically comes down to (% that is complete/BAC)/(% that should have been complete/BAC). Is that correct?

I want to add, this was really really really helpful. I spent close to an hour going over each formula to make certain I understood it fully. Thank you again for this.

Hi Heather,

Thank you for the close analysis of these PMP formulas. Moving step by step,

Yes, we use initial investment in the cost benefit ratio. And you are right, we need to use $100,000. Thank you, it has been updated in the article.

Next, you were not certain about the calculation of Planned Value (PV). Let me explain it here. The planned value is actually the amount (value) of the work that is expected to be completed so far, as per the planned schedule. Now, let’s consider an example –

You have been working on a project that is to be completed in 24 months. The budget for the project is $200,000. Now, after 12 months, as per schedule, 50% of the work should have been completed. What will be the Planned Value (PV) of the project?

Here,

Project Cost = Budget at Completion (BAC) = $200,000

Duration = 24 months

Time Elapsed = 12 months

% Complete = 50% As Per Schedule

So, Planned Value = 50% of the value of total work

PV = 50% of BAC i.e. 50% of 200,000

PV = $100,000

Now, let’s consider Earned Value (EV), it’s actually the value of the work that has been actually completed till date. Let’s have an example (similar one as above) –

You have been working on a project that is to be completed in 24 months. The budget for the project is $200,000. Now, after 12 months, $120,000 has been spent and only 40% of the work has been completed yet. What is the Earned Value (EV) of the project?

Earned Value (EV) = 40% of the value of total work

EV = 40% of BAC i.e. 40% of 200,000

EV = $80,000

Planned Value and Earned Value are the different. Though we use BAC in the calculation of both, but in PV there is % of completed work as per schedule while in EV there is % of total work that has been actually been completed.

Schedule Performance Index = EV/PV = 80,000/100,000 = 0.8

Here, SPI<1, indicates that the project is going at a slower rate.

Hope it clears the concept.

Thanks for this helpful list! Studying for the PMP right now and this is the most comprehensive formula list I’ve found. Saving it in my favorites:)

Thank you for this list of formulas along with detailed explanation in simple words, really helpful.

Amazing blog with detailed description, I was searching this type of blog for while. I really appreciate your efforts, do share more.

in equation 24, shoulsn’t it be that the desired profit is 15,000, according tio the calculation later on?

Thanks for sharing this information, it is very helpful.

very good post

Good List. It’s short and sweet. I really impressed the way you expressed the concepts in formula explanation. Thank you.

Here at this site really the fastidious material collection so that everybody can enjoy a lot. ExcelR Data Analyst Course

Very Informative Article and a great resource to earn such quality knowledge! Thanks for sharing this valuable information. I have been following some of them and still got many to get great knowledge.