Project selection methods IV

This article will cover the following project selection methods

- Break Even Analysis

- Working Capital Ratio

- Law of Diminishing return

- Make or Buy decision making

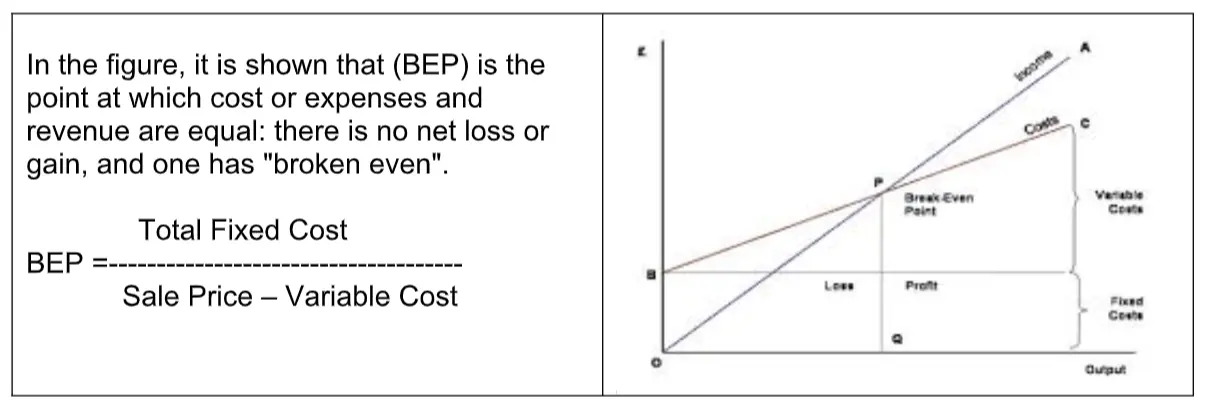

Break Even Analysis

An analysis to determine the point at which revenue received equals the costs associated with receiving the revenue. For example, if a business sells fewer than 300 garments each month, it will make a loss, if it sells more, it will be a profit. With this information, the business managers will then need to see if they expect to be able to make and sell 300 garments per month. Break-even analysis calculates what is known as a margin of safety, the amount that revenues exceed the break-even point. This is the amount that revenues can fall while still staying above the break-even point.

Working Capital Ratio

If a company’s current assets do not exceed its current liabilities, then it may run into trouble paying back creditors in the short term, which can lead to bankruptcy (at times). A declining working capital ratio over a longer time period could also be a warning that requires further analysis. For example, it could be that the company’s sales volumes are decreasing and, as a result, its accounts receivables number continues to get smaller and smaller.

Working Capital = Current Assets – Current Liabilities

Working Capital is a measure of both a company’s efficiency and its short-term financial health. It is also known as “net working capital”.

Working Capital Ratio = Current Assets / Current Liabilities

This ratio indicates whether a company has enough short term assets to cover its short term debt. Anything below 1 indicates negative working capital. While anything over 2 means that the company is not investing excess assets. It is believed that a ratio between 1.2 and 2.0 is ideal.

Current Assets: Includes short term assets like cash, accounts receivable, inventory, short term investments and pre-paid expenses.

Current Liabilities: Includes short term liability of the company like accounts payable, outstanding expenses, payable taxes and short term loans.

Investors are very keen on investing in companies with a good working capital ratio. Not only is a good working capital ratio essential for smooth functioning of the company but also contributes to investments.

The Law of Diminishing Returns

It identifies a basic economic situation where as you put more and more of anything into something you get proportionately less out of it. For example, if you double the number of resources working on a project, it will not necessarily get it done in half time.

Make or Buy decision making

It is a business decision that compares the costs and benefits of manufacturing a product or developing an application against purchasing it. If the purchase price is higher than what it would cost the manufacturer to make it, or if the manufacturer has excess capacity that could be used for that product, or the manufacturer’s suppliers are unreliable, then the manufacturer may choose to make the product. This assumes the manufacturer has the skills and equipment necessary, access to raw materials, and the ability to meet its own product standards. A company who chooses to make rather than buy is at risk of losing alternative sources, design flexibility, and access to technological innovations.

The main decision you’re trying to make is whether it’s more cost effective to buy the products and services or more cost effective for the organization to produce the goods and services needed for the project. Costs should include both direct costs (in other words, the actual cost to purchase the product or service) and indirect costs, such as the salary of the manager overseeing the purchase process or ongoing maintenance costs. Costs don’t necessarily mean the cost to purchase. In make-or-buy analysis, you might weigh the cost of leasing items versus the cost of buying them. For example, perhaps your project requires using a resource with special skill set only for the development part (for few months). In a case like this, contracting might be a better option so that this highly paid resource can be hired only till the project is ready to be implemented.

Other considerations in make-or-buy analysis might include elements such as capacity issues, hardware or software availability, and trade secrets. At times due to critical factors like confidential data, the company decides not to outsource the project. On the other hand your organization has the skills in-house to complete the project but your current project list is so backlogged that you can’t get to the new project for months, so you need to bring in a vendor.

A Real World Example

Vandy is an IT project manager for a financial company in Chennai, India. Recently she transferred to the office headquarters to develop a process for streamlining the scrutiny process of customer’s application for new accounts. She knew that a similar small project was developed by the internal IT team few years back. Her first step was to documents a list of hardware, software and skill sets required for the development of the new application.

She would then weigh the cost of leasing items versus the cost of buying them. After calculating the total cost required for the development, testing and post production support, she would check the availability of the internal team. Then she would look for an appropriate vendor from the potential seller list of her company to check the market price of the application, including the maintenance cost.

Considering all the factors along with the difference in the cost of developing in house versus purchasing the same, she would take the final decision.

For the exam, make sure you’re familiar with all the project selection methods. PMBOK do not cover most of these methods, but from exam perspective you must know about each of these methods.

Questions & Answers

- A company records total sales of $600,000 and carries a cash balance of $7,000. Inventory turnover is $150,000, and accounts receivable is $40,000. What is the company’s net working capital if accounts payable is $52,000?

- A. $120,000

- B. $140,000

- C. $145,000

- D. $200,000

Correct Answer: C. Net Working Capital = Current Assets – Current Liabilities

Net Working Capital = (Cash + Inventory + A/R ) – ( A/P)

$7,000+$150,000+$40,000-$52,000 =$145,000 - A project sponsor requested earned value data on two concurrent projects from the project managers. Both projects are regarded as equally important and strategically beneficial and have been finished by over 75%. He received the following information:

Project A:

PV: Rs 1,700,000; EV: Rs 2,000,000 ; AC: Rs 2,100,000

Project B:

PV: Rs 2,000,000; EV: Rs 1,500,000; AC: Rs 1,600,000

The sponsor considers moving some resources from project A to project B to speed up the second project which is currently behind schedule. What is the most likely outcome of such a measure?- A. Changing team assignments during late course of a project typically increases cost efficiency.

- B. Changing team assignments during late course of a project typically increases time efficiency.

- C. According to the law of diminishing returns, the consolidated cost variance of the two projects will decrease.

- D. According to the law of diminishing returns, the consolidated cost variance of the two projects will increase.

Correct Answer: D. Law of Diminishing Returns is the more you put into something, the less you get out of it.

[/restrict]

Take a Free Demo of Whizlabs PMP Offerings:

PMP Exam Questions

PMP Online Training (with full length videos)

PMP Live Virtual Classroom Training

- What are Scrum roles and why it’s needed? - August 12, 2017

- Stakeholder Analysis – Is it required? - July 28, 2017

- Project Manager – An integrator, how? - July 28, 2017

- Different PMI Certifications – Which one to choose? - July 28, 2017

- What is the importance of Change Management in Project Management? - June 23, 2017

- What’s important to know to build a career in Agile? - June 23, 2017

- Agile Basics, Manifesto & Principles - June 23, 2017

- Scrum – Is it mandatory to learn in today’s IT market? - June 2, 2017